Moving? Why You Need to Notify the IRS and the USPS Separately

Moving can be stressful; but not receiving a payment or notice from the IRS will only add to that stress. The IRS only initiates contact with taxpayers by mail, so it’s important that they have your correct address.

Just because you submit a change of address with the U.S. Postal Service (USPS) doesn’t mean all of your mail will get forwarded automatically. Unfortunately, not all post offices forward all government mail. The good news is that the USPS will update the National Change of Address (NCOA) database when you file an address change.

Just because you submit a change of address with the U.S. Postal Service (USPS) doesn’t mean all of your mail will get forwarded automatically. Unfortunately, not all post offices forward all government mail. The good news is that the USPS will update the National Change of Address (NCOA) database when you file an address change.

Interestingly, in order to improve address quality and obtain postal discounts, the IRS utilizes the NCOA to update taxpayer addresses. The IRS systems perform a series of strict matching routines after which a taxpayer’s address is updated in the IRS’s computer systems. On occasion, a taxpayer’s address is not automatically updated through the use of NCOA. This may occur if the information shared between the NCOA and IRS databases don’t match. That’s why it’s important to notify the IRS of your change of address.

There are a couple of simple methods of notifying the IRS:

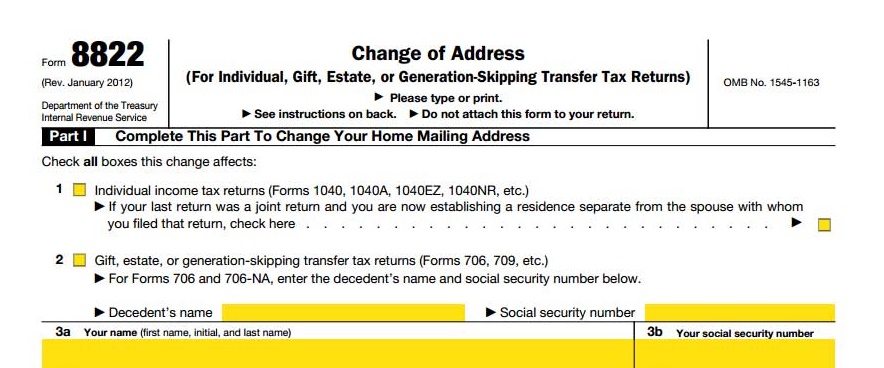

- Use Form 8822, Change of Address;

- Mail a written statement to the address where you filed your last return with your full name, old address, new address and social security number; or

- Call the IRS or go to your local office.